how are property taxes calculated in broward county florida

Transfer taxes would come out to. The estimated tax amount using this calculator is based upon the.

All Broward Cities Raising Taxes But Total Bill Could Fall Sun Sentinel

Florida tax appraisers arrive at a propertys assessed value by deducting the Save Our Homes assessment limitations SOH from the propertys just value.

. The median sale price in Miami is 370738. Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. Census Bureau American Community Survey 2006.

Lands Available for Taxes LAFT Latest Tax Deed Sale Information. The millage rate is a dollar amount per 1000 of a homes taxable property value. Most often taxing municipalities tax levies are consolidated under a single notice from the county.

Learn About Owners Year Built More. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay. Andrews Ave Fort Lauderdale 830am 5pm M-F either full or partial payments by cash check credit or debit cards fees apply.

A number of different. Property taxes in Florida are implemented in millage rates. In Miami-Dade County your rate is 60 cents per 100.

Search all services we offer. The value of your property is determined by your local property appraiser and is based on the propertys fair. Find Details on Broward County Properties Fast.

The BROWARD COUNTY TAX COLLECTOR note. There are three basic. Broward County calculates the property tax due based on the fair market value of the home or property in question as determined by the Broward County Property Tax Assessor.

Room A100 115 S. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply for Business Tax account Run a Business Tax. How Broward County property taxes are determined.

A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value. Broward County Florida Property Tax. THE PROPERTY APPRAISER DOES NOT SET THE PROPERTY TAX RATES.

Fire or Going Out Of Business Sale Permits. Ad Need Property Records For Properties In Broward County. At the Tax Collectors Office.

How Property Tax is Calculated in Broward County Florida. NOT part of our office mails the annual property tax bills. Loading Search Enter a name or address or account number etc 2800 NW 44th St Oakland Park FL - 33309 In fact the rate of return on.

Broward County calculates the property tax due based on the fair market value of the home or property in question as determined by the Broward County Property Tax. Receipts are then distributed to associated parties via formula. 370738100 x 60 222443.

Cities school districts and county departments in Miami-Dade and Broward Counties may set. This tax estimator is based on the average millage rate of all Broward municipalities. Typically Broward County Florida property taxes are decided as a percentage of the propertys value.

Property Tax Appeal Experts Broward Miami Dade Palm Beach Tax Appeal Services

2022 Broward County Trim Proposed Real Estate Tax Notices And Appeals Khani Auerbach Hollywood Fl Real Estate Lawyers

Property Tax Estimator Tools By County

Florida Property Tax Calculator Smartasset

Marty Kiar Broward County Property Appraiser

Florida Property Tax H R Block

Property Taxes In Florida Globalty Investment

Your Real Property Tax Bill When Selling Or Buying Real Estate Real Estate Law Blog

Marty Kiar Broward County Property Appraiser

Broward County Property Appraiser Richr

Property Tax How To Calculate Local Considerations

Broward County Property Appraiser

How To Calculate Fl Sales Tax On Rent

Miami Dade County Fl Property Tax Search And Records Propertyshark

Property Tax Valuations Rose Sharply In Miami Dade And Broward Counties Miami Herald

Broward County Fl Property Tax Search And Records Propertyshark

Explaining The Tax Bill For Copb

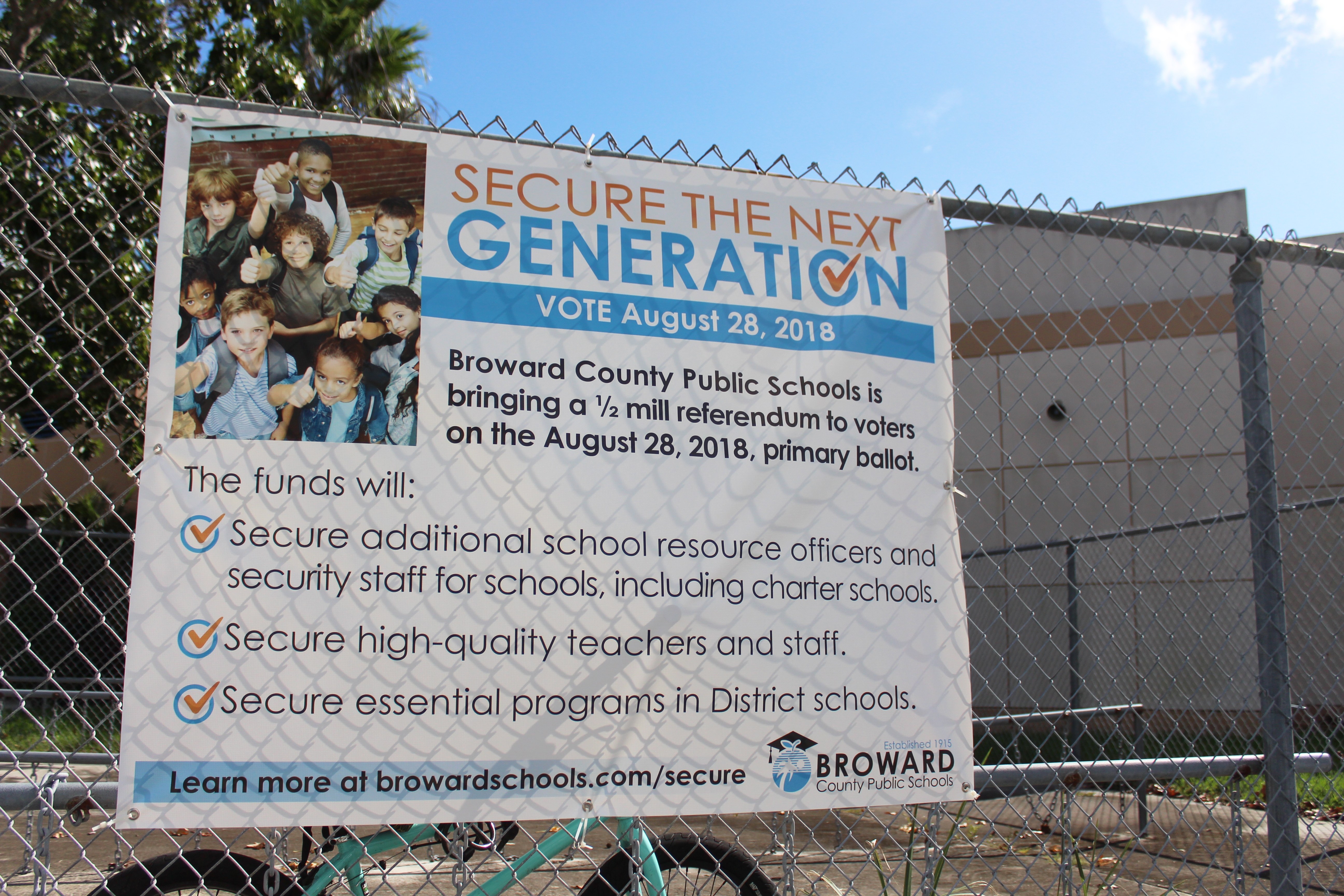

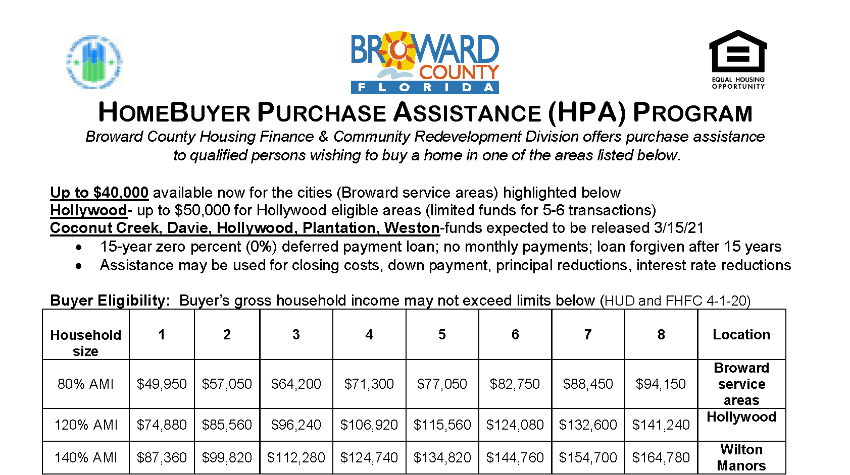

Broward County Resources Housing Foundation Of America

What Will Your Tax Bill Look Like In South Florida This Year